How Much Federal Tax Is Taken Out Of Pension Check?

Key Takeaway:

- Generally, federal income tax is taken out of pension checks. The amount depends on the retiree’s taxable income and tax bracket.

- Taxable income from pensions includes the amount received from the pension plan plus any additional income such as Social Security benefits, investment income, or wages. The retiree’s tax bracket determines the percentage of their income that will be taxed.

- To calculate the federal tax on pension checks, retirees can use the IRS Tax Table or the Tax Brackets Calculator. Withholding allowance and exemptions can also affect the amount of taxes withheld from the pension check.

- Retirees may also be subject to additional taxes like the Medicare tax or the Net Investment Income Tax. However, there are exceptions to these additional taxes, like the exception for qualified retirement plan distributions.

- To ensure proper tax planning, it may be beneficial for retirees to seek professional advice from a tax advisor or financial planner.

As you plan for retirement, it’s important to know how much federal tax will be taken out of your pension check. It can be confusing understanding the tax implications of your pension payments, but this guide will provide you with the information you need.

Federal tax on pension checks

Federal Tax on Pension Checks: What You Need to Know

If you are receiving pension checks, it is important to understand the federal tax implications. The amount of federal tax taken out of your pension check depends on several factors including your taxable income, filing status, and the amount of your pension payments. To know how much is the pension in the USA, you can check out our website for more information.

It is important to note that pension income is generally considered taxable income and may be subject to federal income tax withholding. The amount that is withheld is based on the information you provide on your W-4P form, which is similar to the standard W-4 form used by employees to determine their withholding allowances. If you’re wondering how much is the retirement pension in USA, you can check out our website for more information.

Additionally, if you receive a large lump-sum pension distribution, it may be subject to a higher tax rate. This is because the entire amount is considered taxable income in the year that it is received. If you’re wondering how much tax-free pension lump sum you can get, it’s helpful to consult with a financial advisor who can provide personalized advice based on your specific situation.

To reduce the amount of federal tax taken out of your pension check, you may consider adjusting the withholding amount on your W-4P form or making estimated tax payments. However, if you’re wondering how much the state pension in Ireland is, it is important to consult a tax professional before making any changes to your withholding or payment amounts.

Image credits: retiregenz.com by James Woodhock

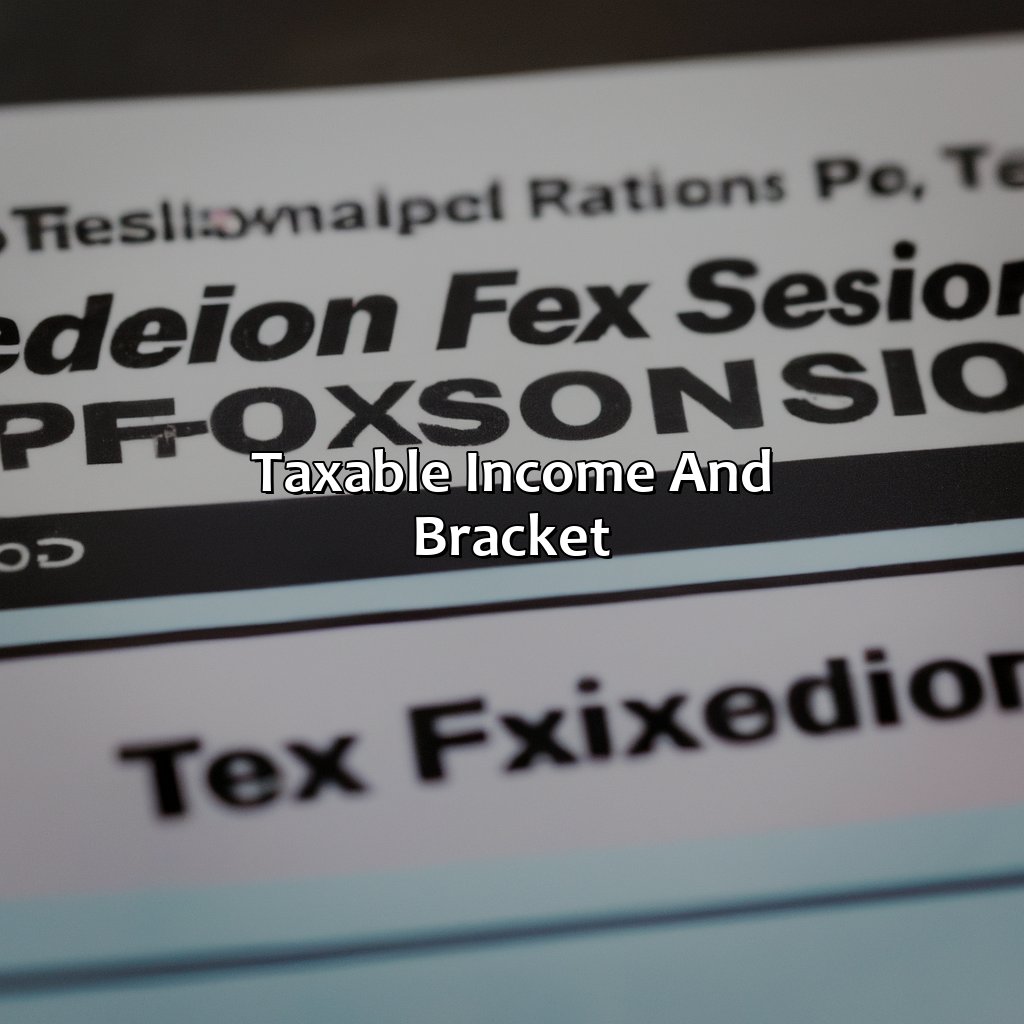

Taxable income and bracket

Understanding Your Taxable Income and Bracket:

When it comes to calculating how military pension is taxed, it’s important to understand the process. Among the factors that determine the amount of tax you will pay on your pension is your taxable income and bracket. Know more about how military pension is taxed here.

Taxable Income and Bracket Table:

| Income Bracket | Tax Rate |

|---|---|

| $0-$9,950 | 10% |

| $9,951-$40,525 | 12% |

| $40,526-$86,375 | 22% |

| $86,376-$164,925 | 24% |

| $164,926-$209,425 | 32% |

| $209,426-$523,600 | 35% |

| $523,600+ | 37% |

Knowing your taxable income and bracket can allow you to estimate the percentage of taxes you will need to pay accurately. Every year these values change moderately, so it’s essential to stay updated.

A crucial point to remember is that not all pensions are taxed the same way. For example, if you contributed and paid the taxes on your contributions, you would not pay taxes on that portion of your pension. Social Security has different rules which should also be considered.

If you find that you are paying too much in taxes on your pension, consider adjusting your withholding by filing a new W-4 form. This type of form will allow you to change the number of exemptions and dependents you claim. You could also try to maximize deductions or contribute to a tax-deferred IRA. Each of these options can reduce your taxable income and ultimately reduce your tax bill.

Image credits: retiregenz.com by Yuval Jones

Calculating federal tax on pensions

Calculating Federal Tax on Pensions:

If you receive a pension, you may wonder how much federal tax is taken out of your check. The answer depends on several factors, such as your taxable income and tax bracket. Here’s a four-step guide to help you calculate federal tax on your pension:

- Determine your taxable income – This includes all sources of income that you must report on your tax return such as Social Security, wages, and other retirement income.

- Calculate your tax bracket – Your tax bracket determines your marginal tax rate, which is the percentage of tax you pay on each additional dollar of income.

- Apply the relevant tax rate – Once you know your tax bracket, you can use it to calculate the amount of tax you owe on your pension income.

- Consider other factors – You may also need to take into account deductions and credits that can lower your tax bill.

When calculating federal tax on your pension, keep in mind that the rules and regulations may vary by state. Additionally, it’s a good idea to consult a tax professional for specific guidance.

Pro Tip: To reduce the impact of federal tax on your pension, consider contributing to tax-advantaged retirement accounts such as Traditional or Roth IRAs.

Image credits: retiregenz.com by Yuval Washington

Withholding allowance and exemptions

When it comes to the amount of federal tax taken out of a pension check, there are certain withholding allowances and exemptions that affect this. These allowances and exemptions determine the amount that an individual can claim as exempt from federal income tax. The more allowances and exemptions claimed, the less federal tax is withheld from the pension check. It is important to note that these allowances and exemptions can change based on factors such as marital status and number of dependents.

Additionally, it is important to understand that while social security benefits are typically not subject to federal income tax, there are certain situations where they may be. For example, if an individual has other sources of income that push their total income over a certain threshold, some of their social security benefits may be subject to federal income tax. To learn more about pension checks and taxes, check out our article on average pension in the US.

It is worth noting that the amount of federal tax withheld from a pension check can be adjusted by filling out a W-4P form with the pension provider. This allows individuals to specify the exact amount of federal tax they want withheld from their pension check. If you are a federal employee, you may also want to know how much pension do federal employees get so you can plan for your retirement accordingly.

A true fact from the IRS website is that for tax year 2021, the standard deduction for individuals who are over 65 years old or blind is $1,350 higher than the standard deduction for individuals who are under 65 and not blind.

Image credits: retiregenz.com by Joel Woodhock

Additional taxes and exceptions

Additional Taxes and Exceptions:

Pensions are a source of income in retirement, and it is essential to know how much tax is taken out of the pension check. Apart from the federal tax, there are other taxes like state tax and local tax, and exceptions like Roth IRA and social security benefits taxes.

If you’re wondering how much tax you pay on pension, it’s important to take these things into account.

When it comes to federal tax, the amount taken out of the pension check depends on many factors like taxable income, tax rate, and the state of residence. Unlike social security benefits, pensions are fully taxable at the federal level, and the tax rate ranges from 10% to 37% depending on the taxable income. Some states exempt federal pensions from state tax, while others tax them fully or partially. Local tax rates may also apply.

Additionally, Roth IRA distributions are not subject to federal tax if the account was held for more than five years and the account owner is 59 or older. Social security benefits are subject to tax if the income exceeds a certain threshold, and the tax rate ranges from 0% to 85% depending on the income level. It is crucial to understand the exceptions and deductions that apply to avoid overpaying taxes.

Image credits: retiregenz.com by James Jones

Seeking professional advice for tax planning

Getting Expert Advice for Optimal Tax Planning

Effective tax planning requires specialized knowledge and expertise that most individuals lack. Seeking guidance from tax professionals will help you make informed decisions on how to minimize your tax liabilities while maximizing your savings. If you are wondering how much is the state pension, it’s important to do your research and consult with professionals before making any financial decisions.

Consulting Tax Professionals for Tax Planning

Professional tax planners, accountants, or financial advisors can help you optimize your financial planning by providing tax-saving strategies and insights personalized to your financial situation. They can identify tax deductions specific to your income type, help fill out your tax forms, and ensure your filing complies with laws and regulations.

Unique Details for Tax Planning Advice

Professional tax planners can also provide you with a comprehensive tax strategy that goes beyond just filling out your tax forms. They can help you plan for long-term financial goals, provide clarity on the tax implications of investment decisions, and offer advice to minimize your tax liabilities while staying compliant. If you’re wondering how much is a government pension, consulting with professional tax planners can also give you insights and guidance.

True Story of Tax Planning Success

A successful business owner sought tax planning advice and discovered that by reorganizing their business structure, they could save tens of thousands of dollars in taxes each year. With the help of a professional tax planner, they were able to create a tax-efficient corporate structure that resulted in significant savings, allowing their business to grow and prosper.

Image credits: retiregenz.com by Joel Jones

Five Facts About How Much Federal Tax Is Taken Out of Pension Check:

- ✅ The federal tax rate for pension income varies depending on your income and tax bracket. (Source: IRS)

- ✅ Federal taxes can be withheld from your pension check if you request it or if the tax liability on your pension exceeds $1,000. (Source: Investopedia)

- ✅ The percentage of federal tax withheld from your pension check can range from 0% to 37%. (Source: SmartAsset)

- ✅ You can use the IRS Tax Withholding Estimator to determine how much federal tax should be withheld from your pension check. (Source: IRS)

- ✅ State taxes may also be withheld from your pension check, and the rate varies by state. (Source: The Balance)

FAQs about How Much Federal Tax Is Taken Out Of Pension Check?

What is Federal Tax and its Impact on Pension Check?

Federal taxes can reduce the amount of retirement income you receive from your pension check. The federal government requires employers to withhold money from employees’ paychecks to pay for taxes.

How much Federal Tax is taken out of Pension Check?

The amount of federal tax taken out of your pension check depends on your tax bracket, filing status, and the amount of taxable income you receive. The basic tax rate for federal income tax is between 10% and 37% of your taxable income.

Are Social Security Benefits Subject to Federal Taxes?

Yes, Social Security benefits can be subject to federal taxes. The amount of taxes you pay on your social security income depends on your income level, marital status, and filing status.

Can I Change the Amount of Federal Taxes Being Withheld from my Pension Check?

Yes, you can change the amount of federal taxes being withheld from your pension check. You can do this by completing a Form W-4P, which is the form used by retirees to determine how much federal income tax to withhold from their pension payments.

What are some Strategies to Manage Federal Taxes on Pension Check?

Some strategies to manage federal taxes on your pension check include delaying your social security benefits, using tax-free investment accounts, and taking advantage of deductions, credits, and exemptions.

Where can I Find More Information about Federal Taxes and Pension Check?

You can find more information about federal taxes and pension check on the IRS website. Additionally, you can speak with a professional tax advisor for personalized advice that fits your specific financial situation.