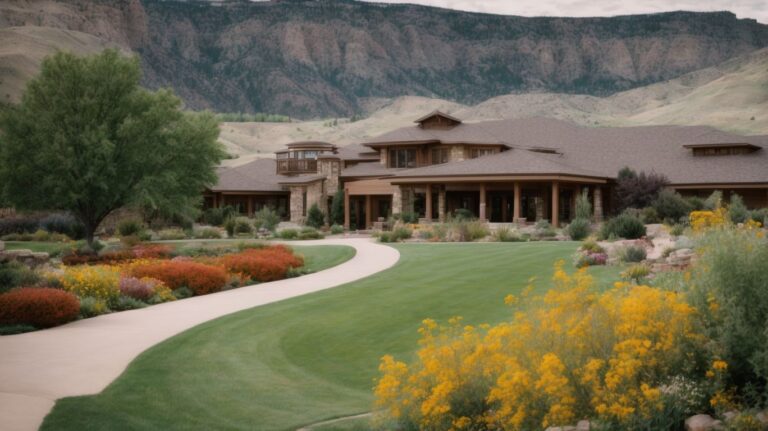

Best Retirement Homes in Worland, Wyoming

Are you or a loved one considering senior living options in Worland, Wyoming? Look no further. In this comprehensive guide, we’ll explore the best retirement homes and senior living communities in Worland, WY, including Beehive Homes of Worland and Worland Healthcare and Rehabilitation Center. We’ll answer frequently asked questions about senior living in Worland, covering…