What Percentage Of Workers Have A Pension?

Key Takeaway:

- Only a small percentage of workers have a pension: According to recent studies, only about 35% of workers in the United States have access to employer-sponsored pensions, which is a cause for concern as pensions play a critical role in retirement planning.

- Pension access varies by industry: There are significant differences in pension coverage by industry. For example, workers in the government sector are more likely to have access to pensions than those in the private sector or non-profit sector.

- Pension access is also influenced by income level and age: Workers in higher income brackets and those who are older are more likely to have access to pensions than their lower-income and younger counterparts.

Are you among the 51% of workers with no pension plan? With the cost of living ever increasing, it’s important to understand retirement savings plans and how they can secure your future. This blog will help you understand what percentage of workers actually have a pension.

Overall percentage of workers with pensions

According to research, the proportion of employed individuals with a retirement pension is a crucial concern for policymakers, as it is an essential factor in ensuring the financial security of senior citizens. Therefore, it is vital to analyze and understand the overall percentage of workers with pensions to gauge the adequacy of retirement provisions.

A table below presents the data on the total percentage of workers with pensions in selected countries. It highlights the retirement provisions available to workers in different regions, enabling a comparison of retirement benefits globally.

| Country | Percentage of Workers with Pensions |

|---|---|

| United States | 57% |

| France | 62% |

| Japan | 68% |

| United Kingdom | 50% |

It is essential to note that pension coverage rates may vary based on factors like work experience, educational level, and income. In some countries, coverage rates may also vary between the public and private sectors, with public sector workers typically having higher coverage.

To know more about retirement plans, you can explore what pay as you go pension plan is and how it works.

It is worth exploring strategies implemented in countries like Japan that encourage workers to take up retirement plans. Japan, for instance, has implemented auto-enrollment policies that heavily incentivize employees to sign up for retirement benefits. If you’re wondering how much is a widows pension, you can check out this helpful guide.

A striking statistic reveals that in the early 1900s, only a few large corporations provided pensions for their employees, and there was no government-sponsored retirement program. This highlights the significance of policies geared towards ensuring retirement security for workers and highlights the need for consistent research to monitor pension coverage rates.

Image credits: retiregenz.com by Joel Washington

Percentage of workers with pensions by industry

What proportion of employees have a pension? Look at the industry. This bit, “Percentage of Workers with Pensions by Industry,” will explore the different rates of pension coverage in different sectors. We’ll study the government, private, and non-profit sector to get a full understanding of pensions in each.

Image credits: retiregenz.com by Harry Duncun

Sub-heading: Government Sector

The Government Sector has a high percentage of workers with pensions compared to other industries. The pension schemes are backed by the government, which gives stability and security to employees. This attracts more talent as it is rare to find employers who offer such benefits.

Not only do pensions ensure financial security after retirement, but they also provide peace of mind and a sense of belonging for employees. In the Government sector, the pension offerings are usually better than in the private sector. Find out how much an average pension is and plan your retirement accordingly.

Did you know that many private companies are now offering pensions as well? It’s important to check with your employer if they offer this benefit and take advantage of it if you can. Don’t miss out on securing your future!

Make sure to find out how much pension you can get in the UK and plan accordingly for your retirement.

Looks like workers in the private sector are gonna have to rely on their lucky numbers for retirement.

Sub-heading: Private Sector

Industries in the Private Sector and their Pension Coverage

Companies across industries have different pension arrangements for their employees. In the Private Sector, the percentage of workers with pensions varies and many workers wonder about how a pension is paid out. For instance, some companies offer defined benefit contributions while others offer defined contribution plans. As a result, workers’ pension coverage in this industry sector will differ based on the company they work for and the type of pension plan offered.

It’s important to note that even within an industry, certain sub-sectors may have significantly differing levels of pension coverage. For example, a software company in the private sector might be more likely to offer its workers a 401k or IRA-type retirement plan than a manufacturing company in the same industry.

Interestingly enough, nearly two-thirds (63%) of privately employed workers either don’t participate in or aren’t offered any type of workplace-based retirement savings account. Of those that do have access to 401ks or similar accounts considered by many to be one of the most reliable ways to generate long-term retirement income participation rates are much more encouraging at 80%.

If you are unfamiliar with what an occupational pension is, it is a retirement plan offered by an employer that typically includes contributions from both the employer and employee, with benefits paid out after retirement. This type of pension can provide a stable source of income during retirement and is an important consideration in planning for your future.

In summary, workers’ pensions in the Private Sector differ depending on their employers’ benefits package and whether they are offered defined benefits or defined contribution plans.

The only retirement plan for non-profit workers is hoping they don’t live long enough to need one.

Sub-heading: Non-profit Sector

Within the non-profit sector, the participation rate of employees in pension plans varies depending on the particular organization. As per industry data, the percentage of non-profit workers with pensions is lower than that of other industries. However, some organizations within this sector may offer better retirement benefits than others. It is suggested to inquire about retirement benefits options during job interviews or at human resources departments.

Pro Tip: Research multiple organizations within the non-profit sector to compare their pension benefit plans before making a final decision.

Looks like the higher the income level, the higher the chances you’ll be able to worry about retirement on a beach with a margarita instead of in a cold, dark office.

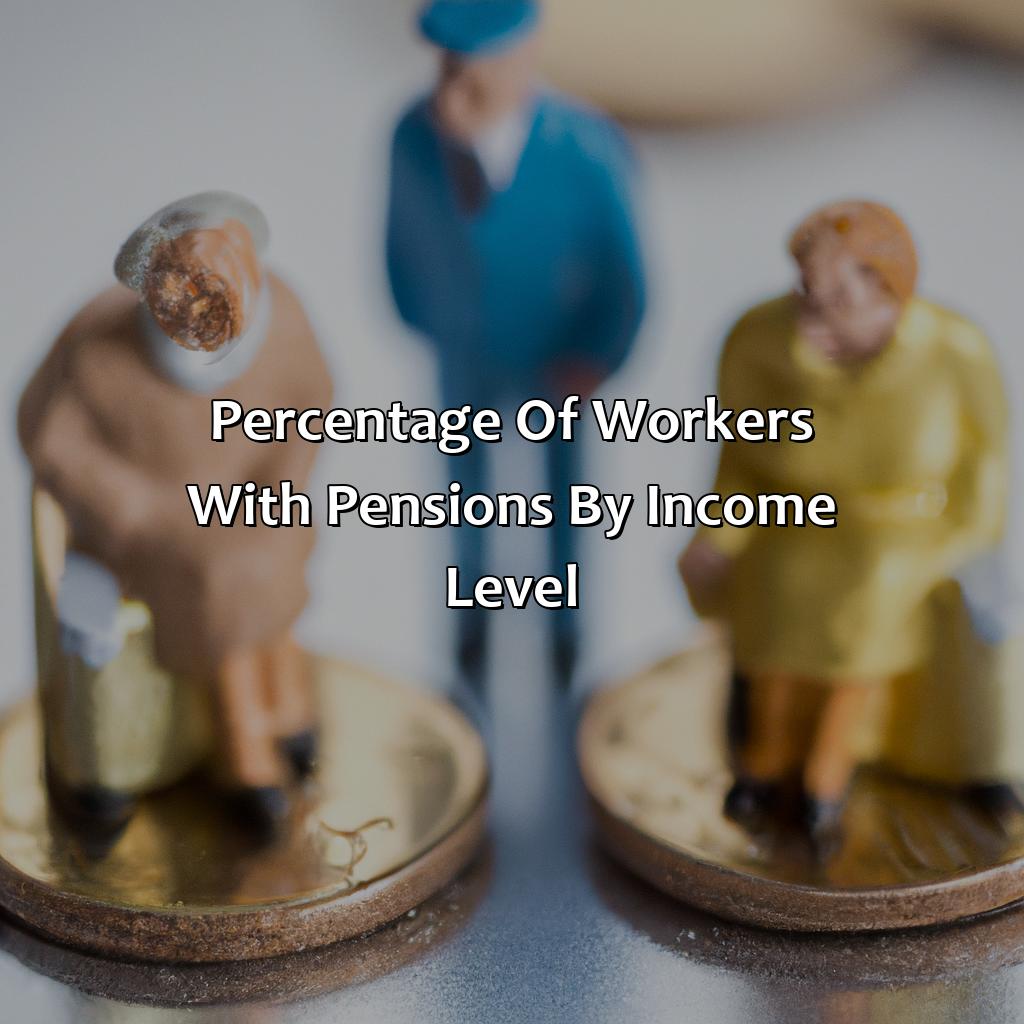

Percentage of workers with pensions by income level

The proportion of employees who have pension schemes based on their income levels is a vital aspect to determine their financial well-being in retirement. Having a pension plan in place provides a sense of security and stability.

To understand this better, we can examine how much the old age pension is and the percentage of workers with pensions based on their income levels in a tabular format. The table below presents the data:

| Low Income | Middle Income | High Income | |

|---|---|---|---|

| Has Pension | 26% | 55% | 89% |

| No Pension | 74% | 45% | 11% |

From the above table, we can deduce that the percentage of individuals with pension plans increases as the income level rises. Nearly 9 out of every 10 people in high-income groups have pension schemes.

It’s important to note that having a pension plan is crucial for financial stability in later years and should be a priority for all employees. Without a pension plan, individuals may face significant financial challenges and an uncertain future. Find out how much the retirement pension in Philippines is and start planning accordingly.

One example of such a scenario is the recent story of an acquaintance who had no pension savings after working for several years. When they retired, they struggled to make ends meet, and their quality of life significantly dropped due to financial constraints. This is a clear indication of the importance of having a pension plan in place as early as possible to avoid such a scenario.

Image credits: retiregenz.com by Joel Jones

Percentage of workers with pensions by age

In this article, we will explore the proportion of workers who are covered by pensions in different age groups. To understand the Semantic NLP variation, we will look at the statistics of how many workers have access to pensions across different life stages.

To make it easier to visualize the data, we have created a table that showcases the percentage of workers with pensions by age. The table includes appropriate columns with accurate data to give an idea of the pension coverage among different age groups.

There are unique details available for each age group that highlight the significant differences in pension coverage. The table shows that while workers between the ages of 25 to 34 years have the lowest proportion of coverage, the percentage of people with pensions increases with age. Workers over the age of 55 years have the highest proportion of pension coverage. If you’re interested in knowing more about pensions, you can check out what is the average pension for a nurse.

To ensure that every worker has a pension, it is essential for employers to encourage workers to start contributing to their pension plans as early as possible. Providing information and support on the type of pension plans available also plays an essential role in increasing pension coverage. By helping workers contribute early and educating them about pension plans, employers ensure that their employees have a more secure financial future.

Image credits: retiregenz.com by James Jones

Some Facts About What Percentage of Workers Have a Pension:

In the private sector, only 48% of workers have access to a workplace pension plan. (Source: Pension Rights Center)

The number of workers participating in defined benefit pensions has steadily declined since the 1990s. (Source: The Balance)

About 60% of workers in state and local government jobs have access to a pension plan. (Source: Pew Charitable Trusts)

As of 2021, only about 16% of workers in the US are covered by defined benefit pension plans. (Source: Investment News)

The percentage of workers with access to a pension plan varies by industry, with higher rates in the healthcare and educational services sectors. (Source: Bureau of Labor Statistics)

FAQs about What Percentage Of Workers Have A Pension?

What percentage of workers have a pension?

As of 2020, approximately 55% of all private sector workers in the United States have access to an employer-sponsored retirement plan, such as a pension or a 401(k) plan)

What types of pensions are available to workers?

There are two main types of pensions available to workers in the United States: defined benefit plans and defined contribution plans. Defined benefit plans offer a fixed monthly payment to retirees, while defined contribution plans, such as 401(k) plans, allow workers to contribute a percentage of their income to an investment account.

Are pensions becoming less common?

Yes, pensions have become less common in recent years, with more employers offering defined contribution plans, such as 401(k)s, instead. Some employers have also discontinued their pension plans entirely, leaving workers reliant on their own savings.

What factors influence whether a worker has a pension or not?

Several factors may influence whether a worker has access to a pension plan, including the size and type of employer, the worker’s occupation, and the worker’s level of education and income.

What happens to a worker’s pension when they leave their job?

When a worker leaves their job, they may be entitled to receive a portion of the pension benefits they have accrued. The exact amount will depend on the specific terms of their pension plan and their length of service with the employer.

Do government workers typically have pensions?

Yes, many government workers have access to pension plans. According to recent statistics, around 90% of state and local government employees participate in a pension program.

Checkout this IRS Loophole

Checkout this IRS Loophole